Cpa Okc for Beginners

Table of ContentsThe Best Strategy To Use For Okc Tax CreditsAn Unbiased View of Tax Accountant OkcThe smart Trick of Okc Tax Deductions That Nobody is DiscussingThe Basic Principles Of Accounting Okc The smart Trick of Tax Accountant Okc That Nobody is Talking AboutThe Greatest Guide To Taxes OkcAn Unbiased View of Real Estate Bookkeeping OkcFascination About Real Estate Bookkeeping Okc

Due to the hectic and complex nature of the modern business world, working with expert accounting services is an essential part of performing your service. Providers for little companies and corporate accounting have actually shown needed throughout the years to help organizations remain abreast of the law and weather periods of hardship.The group at F Silveira would like you to understand 6 things to consider when picking an expert accounting partner (https://www.bark.com/en/us/company/p3-accounting-llc/bAznk/). When selecting from accounting services, you must think about a firm with appropriate knowledge in business, tax, and accounting. With that understanding, they can provide you with important information and vital guidance

Experience in the field of accounting is likewise an excellent procedure of a company's capability. Discovering an accounting company that is always offered when you need their services is essential.

The 10-Minute Rule for Tax Accountant Okc

This helps you develop a strong relationship with your accountant which is required for you to trust them with your financial resources. OKC tax deductions. Paying for financial suggestions can create an avenue for more opportunistic and harmful people to make the most of you. Thus, you need to be wary of accounting services with inflated costs.

Firms that are upfront and transparent about their prices design need to get your factor to consider. A terrific barometer of a firm's performance is its social standing. That is identified by how customers speak about the company. Online evaluations on sites like Yelp can assist identify a company's track record.

Rumored Buzz on Okc Tax Credits

A firm with a broad variety of professors can supply you with many services internal without the requirement to contract out any of your monetary work. Essentials like accounting, monetary preparation, and tax preparation are crucial for a small business accounting service.

How some accounting services conduct their business will likewise suggest how appropriate they are for you. An accounting firm with this function can move rapidly and dedicate fewer errors due to the automation of lots of jobs.

The 3-Minute Rule for Okc Tax Credits

Our firm provides customized services to satisfy all your needs.

The Facts About Bookkeeping Okc Uncovered

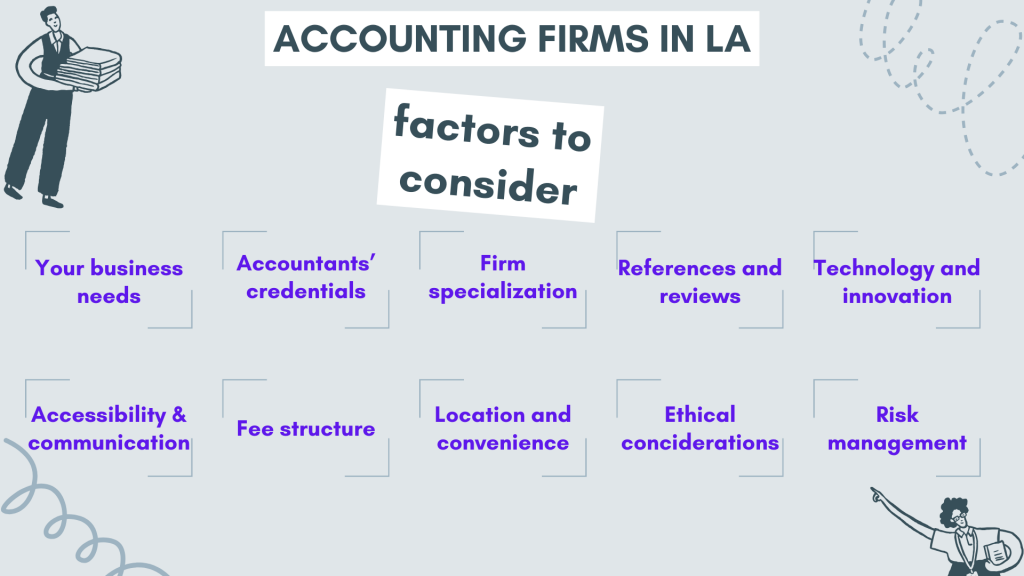

Selecting the right is a vital choice for companies and people alike. Whether you require monetary guidance, tax planning, or auditing services, choosing the best accounting company can substantially affect your financial success. This article will talk about the key factors to consider when assessing and choosing the finest accounting company to fulfill your particular requirements.

How Tax Accountant Okc can Save You Time, Stress, and Money.

A long-standing and positive credibility is an excellent indication of a reputable accounting partner. Certifications and Accreditations: Make sure that the company's accounting professionals and specialists are certified and licensed.

Communication and Accessibility: Effective interaction is crucial when dealing with an accounting firm. Select a company that values customer communication and is accessible when you have concerns or issues. Clear interaction guarantees that you stay notified about your monetary matters and can make knowledgeable decisions. Comprehend the cost structure of the accounting company.

The Single Strategy To Use For Cpa Okc

Transparent pricing and a clear understanding of how you will be billed can help you avoid unforeseen costs. accounting OKC. Consider the size of the accounting firm and how it might affect your experience - https://www.bark.com/en/us/company/p3-accounting-llc/bAznk/. Larger firms might provide a broader variety of services and knowledge however can in some cases lack a personal touch

Choose a company that lines up with your preferences. Place and Availability: If you prefer face-to-face conferences, think about the location of the accounting company.

Indicators on Okc Tax Credits You Need To Know

Evaluating real-life examples of their work can give you a much better understanding of their capabilities and how they can include value to your financial scenario. Selecting the finest accounting company is a decision that needs to not be ignored. Consider the elements talked about in this article to make an educated choice that lines up with your specific monetary needs and objectives.

As a service owner, you understand the ins and outs of your industry. That stated, you'll also require the financial expertise to guarantee your company is established for monetary longevity - CPA OKC. That's why finding the ideal accounting firm can make all the difference in making certain your company's cash is handled well, lessening your tax burden, and beyond